These settings allow you to select a default stop type, set parameters for smart order types, establish offset and range, select risk parameters, identify the quantity for the size buttons, set how OTE/MVO and entries and exits are calculated, enable manual fills, and select the behavior of size buttons.

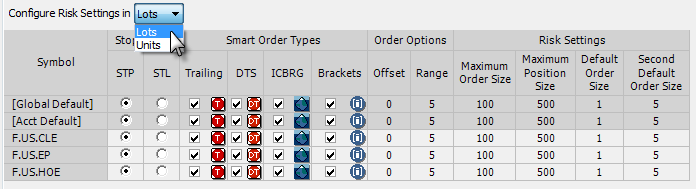

Symbol Settings

First, choose whether you wish to configure these symbols according to lots or units. Separate values are stored for both lots and units. If units is selected, then ICBRG visible size and DOM threshold are defined in units for ICBRG and DOM-triggered orders and for bracket orders.

Then, working across each row, set stop action, smart order types, order options, and risk settings:

Select STP or STL for each symbol listed. This sets the default action when you use the keyboard to place a buy or sell order. Once the default is set, you can still place the order type you did not select. The CTRL key allows you to toggle between the two order types.

Select the check boxes to enable trailing, DOM-triggered stops, iceberg, and bracket orders.

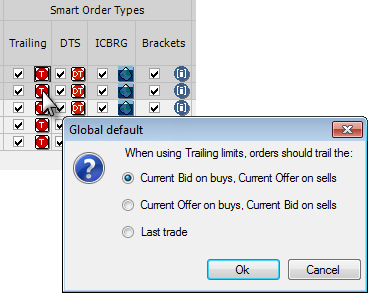

To set default parameters for each type, click the order type icon. Preferences are stored by instrument and account. For example, if you click the trailing icon, you can then choose whether orders trail the current bid and offer or last trade:

Type values for offset and range.

Offset sets the number of ticks between the stop and limit prices on stop limit orders.

Range sets the threshold in number of ticks for a warning that is given if buy orders are placed above the current market, or if sell orders are placed below the market.

The stop limit offset determines the limit price for the order the stop limit becomes when the stop price is hit.

You can use the offset field on Order Ticket also.

Set maximum order size, maximum position size, default order size, and second default order size.

Maximum Order Size sets the maximum quantity for orders placed on this symbol. This setting does not prevent you from exceeding the limit you set, but warns you if you attempt to exceed it.

Maximum Position Size sets the maximum position size for orders placed on this symbol. This setting does not prevent you from exceeding the limit you set, but warns you if you attempt to exceed it.

Default order size is reflected in the size entry field after right-clicking.

The second default order size is used when placing fast-click orders with the middle mouse button. If the second default order size is equal to zero, then you cannot place an order by middle mouse click.

Decimals are allowed for order size.

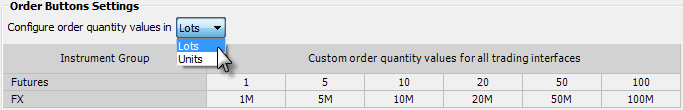

Order Button Settings

First, choose whether you wish to configure these symbols according to lots or units. Separate values are stored for both lots and units.

Then, enter values for order quantity buttons.

For FX futures values, K = thousand, M = million, and B = billion. Quantities greater than 4 digits should be abbreviated.

Default values are: 1, 5, 10, 20, 50, 100 for futures and 1M, 5M, 10M, 20M, 50M, 100M.

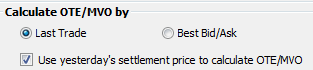

Calculating OTE/MVO by

Select whether Open Trade Equity (OTE) and Market Value of Options (MVO) are calculated by Last Trade or by Best Bid/Ask.

Selecting use yesterday’s settlement tells the system to calculate OTE/MVO using yesterday’s settlement price. This is especially helpful for traders using the API, who want to force a specific calculation method, avoiding situations where the calculation is based on whatever data is available.

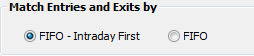

Match Entries and Exits by

Select whether Entries and Exits are matched by First In/First Out (FIFO) by selecting either FIFO – Intraday First or FIFO.

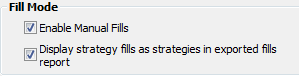

Fill Mode

Select the first check box for the ability to enter manual fills.

Select the second check box to group strategy leg fills as strategies in the fills report, otherwise the report displays fills by leg.

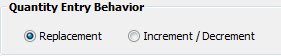

Quantity Entry Behavior

Choose whether order quantity buttons when clicked should replace the existing quantities or increment and decrement the existing quantities.