This section is a complete guide to CQG Trader symbology, including how to enter symbols and how to format symbols.

For a complete list of tradable symbols, see CQG Tradable Symbols.

On Quote Board and Quote Spreadsheet, symbols are entered directly in a field. Go to a cell, and type the symbol.

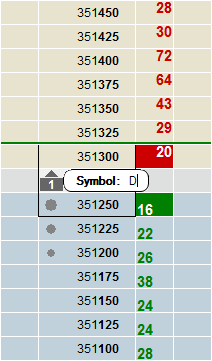

On DOMTrader and Order Ticket, the symbol entry field becomes visible only when you start typing a symbol:

|

Product |

Format |

Example |

|

Currencies |

X.<symbol> |

X.FXEURUSD |

|

Futures |

F.<symbol><month code><year> |

F.DDM3 |

|

Options |

C.<symbol><month code><year><strike price> P.<symbol><month code><year><strike price> |

C.SPZ081500 |

|

Stocks |

S.<symbol> |

S.MSFT |

Futures Symbology

Format: F.<symbol><month code><year>

Example: SPU14 = September 2014 S&P 500 futures contract

For currently traded (non-expired) contracts, the lead digit of the year can be omitted, e.g. USAZ4.

Symbol are mapped to commodity symbols before contracts. Therefore, entering SF displays the lead month for Swiss Francs, rather than January soybeans. For soybeans, include the year, SF3.

|

For specific contracts |

Type |

|

most active futures contract |

<symbol>? |

|

first non-expired futures contract |

<symbol>?1 |

|

second non-expired futures contract |

<symbol>?2 |

|

seventh non-expired futures contract |

<symbol>?7 |

Months:

|

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

F |

G |

H |

J |

K |

M |

N |

Q |

U |

V |

X |

Z |

Format (calls): C.<symbol><month code><year><strike price>

Format (puts): P.<symbol><month code><year><strike price>

Strike price: 2-5 digits.

Year: Must be two digits.

Example: C.SPZ141500 = December 2014 1500 call on the S&P 500 futures contract.

Alternative: C.<symbol>_<month code><year>.<strike price>

Alternative: P.<symbol>_<month code><year>.<strike price>

Example: C.SP_U14.1500 = September 2014 1500 call on the S&P 500 futures contract.

|

For specific contracts |

Type |

|

at the money for the nearby month |

C.<symbol>? P.<symbol>? |

|

at the money for some other month |

C.<symbol><month><year>? CTRL+ENTER P.<symbol><month><year>? CTRL+ENTER |

|

strikes for the most active month |

C.<symbol>? CTRL+ENTER P.<symbol>? CTRL+ENTER |

Exchange-Traded Strategy Symbology

|

Strategy |

Formula |

|

Bundle |

underlying contract + B + number of years + month + year |

|

Bundle |

underlying contract + BS + number of years + month + year |

|

Butterfly |

underlying contract + L + interval + month + year |

|

Calendar spread |

underlying contract + S + strategy leg gap + month + year |

|

Condor |

underlying contract + C + interval + month + year |

|

Double butterfly |

underlying contract + D + interval + month + year |

|

Intercommodity spread, offset |

underlying contract + underlying contract + I + leg gap + month + year |

|

Intercommodity spread, reverse offset |

underlying contract + underlying contract + WI + leg gap + month + year |

|

Intercommodity spread, same month |

underlying contract + underlying contract + I0 + month + year |

|

Inter-exchange spread, offset |

underlying contract + underlying contract + I + leg gap + month + year |

|

Inter-exchange spread, reverse offset |

underlying contract + underlying contract + WI + leg gap + month + year |

|

Inter-exchange spread, same month |

underlying contract + underlying contract + I0 + month + year |

|

Pack |

underlying contract + P + number of the pack + month + year |

|

Pack butterfly |

underlying contract + PB + interval + month + year |

|

Pack spread |

underlying contract + Y + interval + month + year |

|

Reduced tick calendar spread |

underlying contract + R + strategy leg gap + month + year |

|

Reverse spread |

underlying contract + W + strategy leg gap + month + year |

|

Strip |

underlying contract + T + interval + month + year |

|

TAS |

underlying contract + T + month + year |

|

Treasury intercommodity spread |

spread’s own symbol + month + year |