|

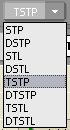

Stop Management Menu

STP (stop), DSTP (DOM-Triggered stop), STL (stop limit), DSTL (DOM-Triggered stop limit), TSTP (trailing stop), DTSTP (DOM-Triggered trailing stop), TSTL (trailing stop limit), and DTSTL (DOM-Triggered trailing stop limit) are the stop management options. DOM-Triggered Stops must be enabled in preferences.

STP is the default. A stop order becomes a market order when the stop price is hit and a stop-limit order becomes a limit order when the stop price is hit.

STL orders allow the trader to set a difference between the stop price and the limit price.

TSTP and TSTL orders adjust their trigger price in concert to the direction of the market on a tick-by-tick basis, initially trailing the market with the same distance to the market price when the order is first placed. The trigger price of a trailing sell stop order will automatically step higher with the market for each up tick, but will not step lower.

DSTP, DSTL, DTSTP, and DTSTL orders behave like stop orders, but are not triggered until the bid/ask quantity falls below the orders trigger quantity (DOM threshold).

Your account must have the synthetic order route turned on to place these orders. DTS and trailing orders require an enablement.

Even if an exchange does not support Stop or Stop/Limit orders, the order gateway can create those order types, and these created orders are called synthetic orders. Order types that are accepted by the exchange for a given symbol display a peach rectangle around the selection button. If the order type selection button is displayed against a white rectangle, that order type is not supported by the exchange, and a synthetic order will be used to place that type of order on this exchange, if it is selected.

|

CQG |